Catharcism in New Jerusalem

“Downfall of Mother Bank” (1833) is a pro‑Andrew Jackson political cartoon by New York lithographer Henry R. Robinson that celebrates Jackson’s attack on the Second Bank of the United States during the so‑called “Bank War.” It mocks the Bank and its elite defenders as they are toppled by Jackson’s order to remove federal deposits, portraying the institution as a corrupt “Mother Bank” brought down for the good of ordinary Americans.

0. INTRODUCTION

Thank you for clicking and taking the time to dig into Yeetum’s work. I have been focused on this topic for a while and I think its the nexus to US Civic and Cultural Stability.

This post is a follow up to my macroeconomic thesis The Great Capitulation and the conception of Cyber Estates and Network States is the modern day form of sovereignty and power projection. We will explore further the mechanics of how my thesis could ✨manifest✨.

You can read more of my writings on X, Substack, and some older Linkedin + Medium posts. I recommend reading this first as a base to understand this in a biblical sense ELI5: Modern Money Magic

We hope you found this report insightful and actionable to protect your Family and Community. Get involved via our Y2 platform, Y2.

1. EXECUTIVE SUMMARY (BLUF)

BOTTOM LINE UP FRONT: The US financial system is currently operating under a “Barbell” risk structure that is structurally fragile to both domestic liquidity shocks and geopolitical sabotage.

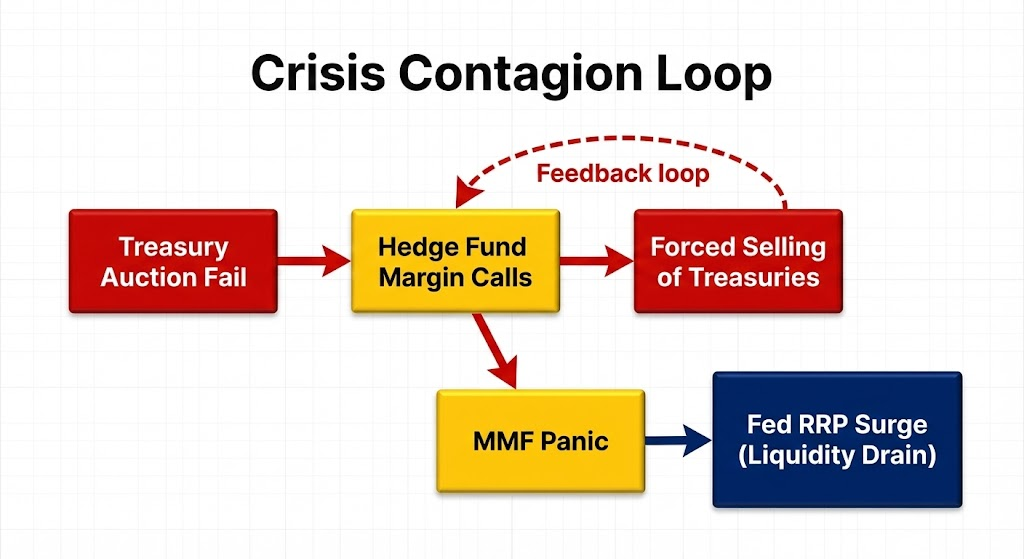

On November 26, 2025, a simulated failure of a US Treasury 7-Year Note auction triggered a cascading de-leveraging event (“The Thanksgiving Turmoil”). A 4-sigma spike in Treasury yields forced highly leveraged Hedge Funds to unwind massive “Basis Trade” positions, a risk specifically flagged by the Federal Reserve in October 2025 as having “massive increase” in exposure [Source: Fed Notes, Oct 2025]. This panic caused Money Market Funds (MMFs) to flee private lending markets, spiking Federal Reserve Overnight Reverse Repo (ON RRP) usage by $950 Billion in a single session.

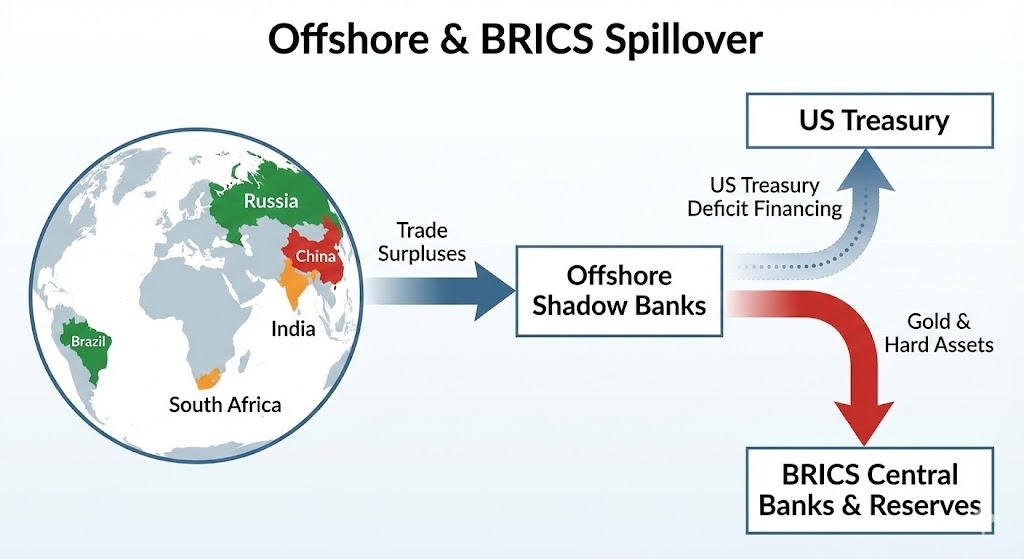

Simultaneously, adversarial financial actors (BRICS bloc) are operationalizing “The Unit” (Gold-backed currency) and mBridge (digital rails) to bypass the US Dollar entirely [Source: BIS mBridge Update], removing the offshore liquidity buffer that historically dampened domestic crises.

2. THREAT LANDSCAPE: THE DOMESTIC “BARBELL”

The financial system is polarized between “Safety Traps” and “Leverage Traps,” creating a fragile equilibrium.

A. The “Stragglers” (Safety Trap)

This is your dollars inside Vanguard, Fidelity, Schwab, etc. Basically all US retirement equity funds.

- Entities: Vanguard VMFXX, Fidelity SPAXX, GSEs.

- Behavior: Rejecting Market Beta (T-Bills @ 4.05%) for Sovereign Alpha (Fed RRP @ 3.75%).

- Validation: New York Fed data confirms these specific funds remain the primary counterparties for the RRP facility [Source: NY Fed Counterparty List].

- Risk: This capital is “dead” to the real economy. It sets a high floor for rates and acts as a liquidity dampener.

B. The “Leveraged” (Prime Brokerage Clients)

- Entities: Multi-Strategy Hedge Funds (“Pod Shops”), Macro Funds.

- Mechanism: Bilateral Repo & Prime Brokerage Margin Lending.

- Vulnerability: Highly leveraged “Basis Trades” (Long Cash Treasury / Short Future). Recent academic work highlights how dealer balance sheet constraints create specific fragility in this sector [Source: J. Stein, Treasury Market Dysfunction, March 2025].

3. PHASE I: THE SIMULATION (“The Thanksgiving Turmoil”)

The Trigger Event

- Date: Nov 26, 2025

- Event: US Treasury 7-Year Note Auction “tails” by 5.2 basis points.

- Result: Yields spike +23 bps instantly.

The Propagation (The “Basis Trade” Unwind)

Hedge funds running 50x leverage on Treasury spreads faced immediate insolvency.

- Mathematic Failure:

- Pre-Crash: Net Carry = +0.10%.

- Crash: Repo Rates spiked to 5.15% (vs 4.20% Yield).

- Result: Net Carry = -0.95% x 50 Leverage = -47.5% Daily Loss.

- The Algo Reaction: Automated risk engines liquidating portfolios instantly. This “crowded trade” risk was explicitly warned against by Federal Reserve Governor Cook in late 2025 [Source: Financial Times / Hedgeweek].

The Liquidity Drain

Money Market Funds (MMFs) stopped lending to banks and parked cash at the Fed.

- RRP Volume Change: Spiked from $1.45T to $2.40T overnight.

- Impact: Private Repo Market froze. SOFR spiked to 5.15%.

4. PHASE II: POST-INCIDENT FORENSICS

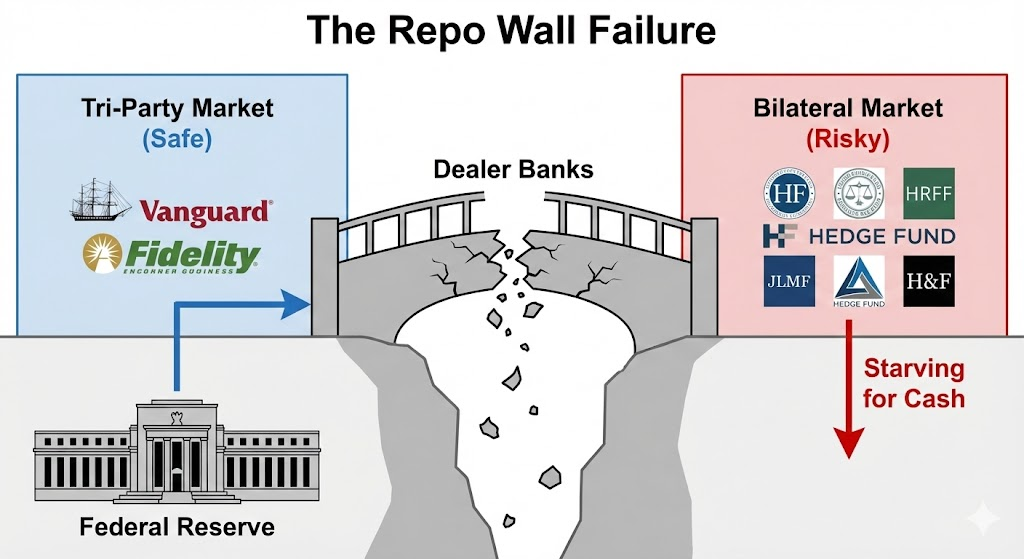

The “Plumbing” Failure: The Repo Wall

Liquidity could not cross the barrier between safe “Tri-Party” repo and risky “Bilateral” repo. This segmentation is a known structural flaw in the US Repo market [Source: OFR Annual Report 2024].

Systemic Vulnerability Scoring (CVSS Style)

| Vector | Score | Severity | Description |

|---|---|---|---|

| Liquidity Mismatch | 6.5 | MEDIUM | MMFs offer daily liquidity on assets that may freeze. |

| Hidden Leverage | 9.0 | CRITICAL | Regulators cannot see the re-hypothecated collateral chain, specifically in Cayman-domiciled funds which underreport by ~$1.4T [Source: Fed Notes 2025]. |

| Interconnectedness | 8.5 | HIGH | Top 6 US Banks hold >60% of exposure to Shadow Banks. |

5. PHASE III: GEOPOLITICAL DIMENSIONS (BRICS & OFFSHORE)

The domestic crisis is amplified by the breakdown of the global dollar cycle.

The Offshore Liquidity Pipeline

Historically, BRICS trade surpluses were recycled into US Treasuries. This flow has reversed as “The Unit” gains traction.

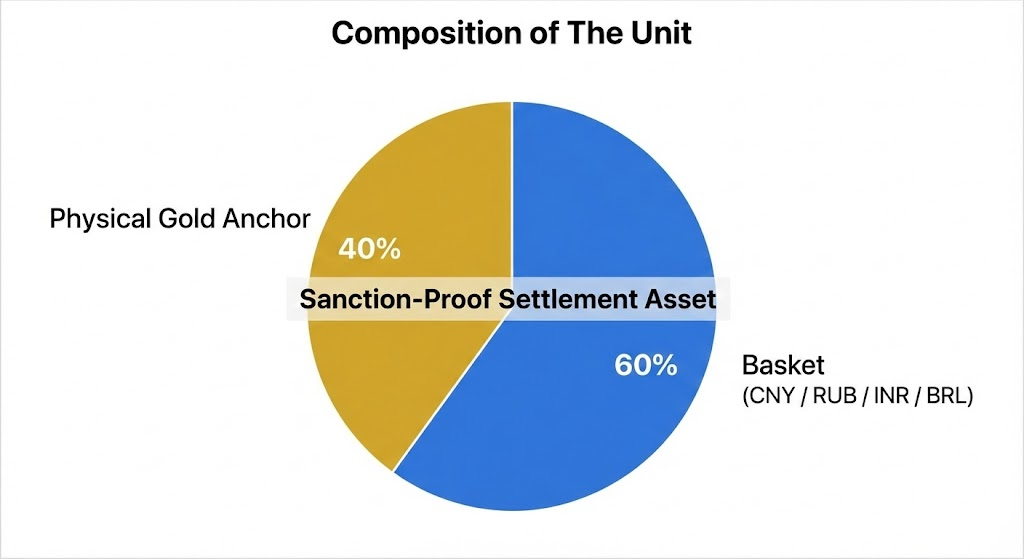

Adversarial Architecture: “The Unit”

BRICS nations are operationalizing a competitor collateral system.

- Structure: 40% Gold Backing + 60% Sovereign Currency Basket.

- Validation: Reports indicate BRICS nations possess >5,600 metric tons of gold to back this pilot [Source: Discovery Alert / World Gold Council].

- Impact: Creates a permanent bid for Gold ($4,100/oz) and displaces Treasury demand.

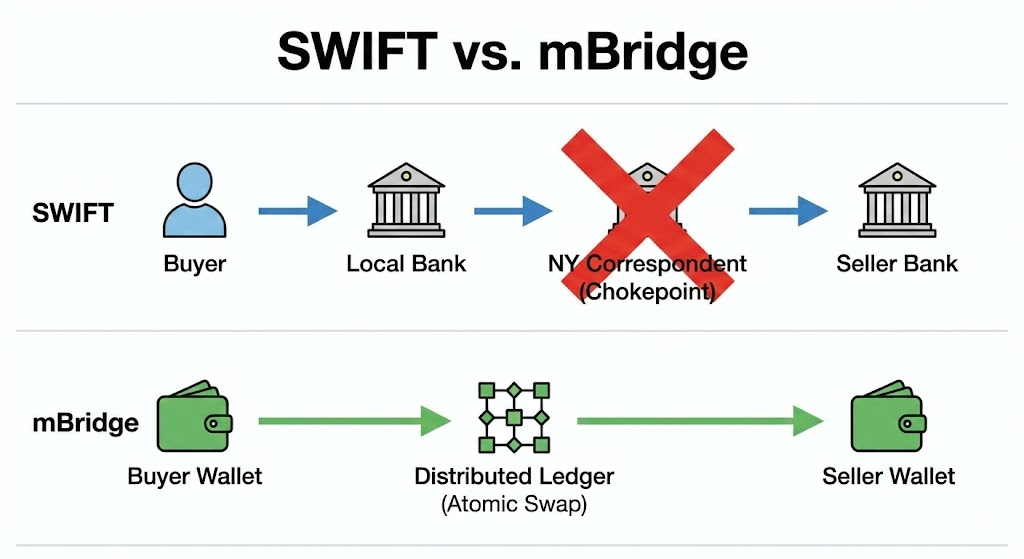

The Digital Bypass (mBridge)

A mechanism to settle trades without touching the US banking system.

- Status: The BIS confirmed mBridge reached “Minimum Viable Product” stage, facilitating real-value transactions [Source: BIS Innovation Hub].

6. STRATEGIC POTENTIALS

Focus solely on defense industrial base productive capital allocation small business proliferation.

A. CRITICAL: Domestic Renaissance

- Anoint Regional Industrial Bases with Bottom-Up, Non-Usurious Financial Facilities:

Ditch the unproductive “fugazi” of econometrics. Directly pipe money to incentivize the rapid spawning of critical industrial base facilities, empowering trusted national interest agents to accelerate advanced engineering, convergent technology, and additive manufacturing ecosystems - all with on-par rates and scaled liquidity privileges limited to Federal Reserve Member Banks.

I can’t stress enough the importance of the above in the context of restoring cultural and civic stability in urban zones, serving as a generational counterforce to “Wealth of Nations” ideals.

To buy time on debt backed money:

- Mandatory Central Clearing: Force all Treasury Repo trades through FICC to eliminate counterparty panic.

- Expanded SRF: Allow Hedge Funds and MMFs to access the Standing Repo Facility directly (bypassing failed dealers).

B. Geopolitical Patch

- Digitize the Dollar: Compete with mBridge speed.

- “Friend-Shoring” Liquidity: Establish permanent, unlimited Swap Lines with EU/Japan/UK to create a “White-Listed” offshore dollar zone and expand into South America via El Salvador.

- Regulate the Grey Zone: Federal charters for Stablecoin issuers (Tether/Circle) to bring “Digital Eurodollars” under US surveillance.

C. FINSEC Watchlist (REAL TIME DASHBOARDS)

| Indicator | Code | Threshold (Danger Zone) | What it Means |

|---|---|---|---|

| Repo Fails-to-Deliver | FAIL_VOL | > $50 Billion / Day | Dealers are running out of specific collateral. System “grease” is drying up. |

| OIS-Libor Spread | FRA_OIS | > 35 bps | Banks are scared to lend to each other. A sign of hidden insolvency. |

| Cross-Currency Basis | XCCY_EUR | < -20 bps | Foreign banks (Europe/Japan) are desperate for Dollars. Signals global contagion. |

| BRICS Treasury Holdings | BRICS_UST | > $50B Monthly Decline | Coordinated selling or a refusal to roll over maturing debt. |

| Offshore Dollar LIBOR/SOFR Spread | OFF_ON_SPD | > 40 bps | Offshore dollar funding is becoming much more expensive than domestic funding, signaling a breakdown in the global dollar market. |

| Gold Purchases by BRICS Central Banks | BRICS_GOLD | Sustained high volume | A clear signal of de-dollarization and a move towards an asset-backed alternative currency. |

| BRICS Pay System Volume | BRICS_PAY | Exponential Growth | Adoption of a non-dollar trade settlement mechanism is gaining traction. |

This is an excerpt from Tobalo Torres-Valderas + Gemini 3's Catharcism in New Jerusalem article. If you want to support us consider evangelizing free users or upgrade to a paid plan on Y2.